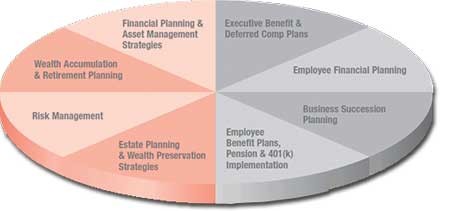

Our Services

Centric Advisors offers independent financial management and advisory services for individuals and businesses in the following areas:

|

|

|

|

|

|

|

|

Whether it's developing a personal financial roadmap, implementing a needs-based family insurance strategy, creating a customized executive benefits program for a business or architecting a tax-advantaged qualified retirement program for business owner, we AIM to provide a holistically planned, innovative and practical financial programs for our valued clients.

We have access to products and services from an incredible array of market-leading companies, which allows us to develop client-centric, needs-focused financial strategies.

Individual Retirement

- Retirement Needs Analysis

- Traditional and Roth IRAs

Qualified Employer Sponsored Retirement Plans

- Defined Contribution - 401(k), 403(b)

- Defined Benefit

- Profit Sharing

- SEP & Simple IRAs

Non-Qualified Business Owner/Executive Benefits

- Executive Bonus Plan (section 162)

- Deferred Compensation (457 plan)

- Split-Dollar Life Insurance

Annuities (Guaranteed Lifetime Income)

- Fixed (single flexible & immediate)

- Variable Annuities (immediate & flexible payment)

- Equity Indexed Annuities

Life Insurance (Tax-Free Supplemental Retirement Income)

- Whole Life

- Universal Life

- Variable Universal Life

Business Planning

- Buy-Sell Agreement

- Key-Person Coverage

- Business Succession Plan

- Stock Redemption Plans

Family Protection

- Annual Renewable Term

- Level Term — 10-, 15- , 20- and 30-Year

- Whole Life

- Universal Life

- Variable Universal Life

- Survivorship Variable Universal Life

- Survivorship Universal Life

Disability Risks

- Individual Disability Income

- Individual Long-Term Care

Life Insurance

- Annual Renewable Term

- Level Term — 10-, 15- , 20- and 30-Year

- Whole Life

- Universal Life

- Variable Universal Life

- Survivorship Variable Universal Life

- Survivorship Universal Life

Annuity

- Qualified Longevity Annuity Contract

- Stretched IRA

- Deffered RMD

Fixed-Income Investments

- Mutual Funds (income-oriented)

- Municipal and Government Bonds

- Money Markets

- Certificates of Deposit

Equity Investments

- Mutual Funds (growth-oriented)

- Large Cap Growth/Value Funds

- Small/Mid Cap Growth/Value Funds

- International Equity Funds

- Asset Allocation Funds

- Sector Funds

- ETFs

- Publicly Traded Stocks

Financial Planning

- Non-Fee Needs Analysis

- Personal Financial Plans

- Focused Needs Plans

- Personal Financial Plans with Estate Planning